第一章 单元测试

1、单选题:The Bluebird Company has a $10,000 liability it must pay three years from today.

The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $2,500 a year for the next three years, starting one year from today. The account pays a 3% rate of return. How much does the Bluebird Company need to deposit today? ()

A:$4,276.34

B:$3,108.09

C:$1,867.74

D:$2,079.89

正确答案:【$2,079.89

】

2、单选题:Suzette is going to receive $10,000 today as the result of an insurance settlement. In addition, she will receive $15,000 one year from today and $25,000 two years from today. She plans on saving all of this money and investing it for her retirement. If Suzette can earn an average of 11% on her investments, how much will she have in her account if she retires 25 years from today? ()

A:$595,098.67

B:$546,072.91

C:$536,124.93

D:$541,414.14

正确答案:【$595,098.67

】

3、单选题:You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the value of this investment one year from now? ()

A:discounted value

B:present value

C:principal amounts

D:future value

正确答案:【future value

】

4、单选题:Sara invested $500 six years ago at 5 percent interest. She spends her earnings as soon as she earns any interest so she only receives interest on her initial $500 investment. Which type of interest is Sara earning?

A:complex interest

B:simple interest

C:interest on interest

D:free interest

正确答案:【simple interest】

5、单选题:Shelley won a lottery and will receive $1,000 a year for the next ten years. The value of her winnings today discounted at her discount rate is called which one of the following? ()

A:present value

B:simple amount

C:future value

D:single amount

正确答案:【present value

】

6、单选题:Which one of the following will produce the highest present value interest factor? ()

A:8 percent interest for five years

B:6 percent interest for eight years

C:6 percent interest for ten years

D:6 percent interest for five years

正确答案:【6 percent interest for five years

】

7、单选题:Which one of the following terms is defined as a conflict of interest between the corporate shareholders and the corporate managers? ()

A:agency problem

B:corporate breakdown

C:bylaws

D:articles of incorporation

正确答案:【agency problem

】

8、单选题:Which one of the following is a capital budgeting decision? ()

A:deciding whether or not to purchase a new machine for the production line

B:deciding how to refinance a debt issue that is maturing

C:determining how much inventory to keep on hand

D:determining how many shares of stock to issue

正确答案:【deciding whether or not to purchase a new machine for the production line

】

9、多选题:Which of the following questions are addressed by financial managers? ()

A:Should the firm borrow more money?

B:Should customers be given 30 or 45 days to pay for their credit purchases?

C:Should the firm acquire new equipment?

D:How should a product be marketed?

正确答案:【Should the firm borrow more money?

;Should customers be given 30 or 45 days to pay for their credit purchases?

;Should the firm acquire new equipment?

】

10、多选题:Which of the following should a financial manager consider when analyzing a capital budgeting project? ( )

A:project start up costs

B:dependability of future cash flows

C:dollar amount of each projected cash flow

D:timing of all projected cash flows

正确答案:【project start up costs

;dependability of future cash flows

;dollar amount of each projected cash flow

;timing of all projected cash flows

】

第二章 单元测试

1、单选题:The formula which breaks down the return on equity into three component parts is referred to as which one of the following? ( )

A:Du Pont identity

B:equity equation

C:SIC formula

D:profitability determinant

正确答案:【Du Pont identity

】

2、单选题:A firm uses 2008 as the base year for its financial statements. The common-size, base-year statement for 2009 has an inventory value of 1.08. This is interpreted to mean that the 2009 inventory is equal to 108 percent of which one of the following? ( )

A:2008 inventory

B:2009 total assets

C:2008 total assets

D:2008 inventory expressed as a percent of 2008 total assets

正确答案:【2008 inventory expressed as a percent of 2008 total assets

】

3、单选题:If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be which one of the following? ( )

A:0.0

B:1.0

C:1.5

D:0.5

正确答案:【0.5

】

4、单选题:Which one of the following will decrease if a firm can decrease its operating costs, all else constant? ( )

A:profit margin

B:return on assets

C:return on equity

D:price-earnings ratio

正确答案:【price-earnings ratio

】

5、单选题:During the year, Kitchen Supply increased its accounts receivable by $130, decreased its inventory by $75, and decreased its accounts payable by $40. How did these three accounts affect the firm’s cash flows for the year? ( )

A:$165 use of cash

B:$245 use of cash

C:$95 source of cash

D:$95 use of cash

正确答案:【$95 use of cash

】

6、单选题:A firm generated net income of $878. The depreciation expense was $47 and dividends were paid in the amount of $25. Accounts payables decreased by $13, accounts receivables increased by $22, inventory decreased by $14, and net fixed assets decreased by $8. There was no interest expense. What was the net cash flow from operating activity? ( )

A:$876

B:$904

C:$902

D:$922

正确答案:【$904

】

7、单选题:The Bike Shop paid $2,310 in interest and $1,850 in dividends last year. The times interest earned ratio is 2.2 and the depreciation expense is $460. What is the value of the cash coverage ratio? ( )

A:2.21

B:2.40

C:1.67

D:1.80

正确答案:【2.40

】

8、单选题:Canine Supply has sales of $2,200, total assets of $1,400, and a debt-equity ratio of 0.3. Its return on equity is 15 percent. What is the net income? ( )

A:$152.09

B:$156.67

C:$141.41

D:$138.16

E:$161.54

正确答案:【$161.54

】

9、单选题:Which one of the following terms is applied to the financial planning method which uses the projected sales level as the basis for determining changes in balance sheet and income statement account values? ( )

A:common-size method

B:sales reconciliation method

C:percentage of sales method

D:sales dilution method

正确答案:【percentage of sales method

】

10、单选题:Financial planning: ( )

A:is a process that firms employ only when major changes to a firm’s operations are anticipated.

B:is a process that firms undergo once every five years.

C:focuses solely on the short-term outlook for a firm.

D:considers multiple options and scenarios for the next two to five years.

正确答案:【considers multiple options and scenarios for the next two to five years.

】

11、单选题:A firm is currently operating at full capacity. Net working capital, costs, and all assets vary directly with sales. The firm does not wish to obtain any additional equity financing. The dividend payout ratio is constant at 40 percent. If the firm has a positive external financing need, that need will be met by: ( )

A:fixed assets.

B:accounts payable.

C:retained earnings.

D:long-term debt.

正确答案:【long-term debt.

】

12、单选题:Which one of the following will cause the sustainable growth rate to equal to internal growth rate? ( )

A:debt-equity ratio of 1.0

B:dividend payout ratio greater than 1.0

C:equity multiplier of 1.0

D:retention ratio between 0.0 and 1.0

正确答案:【equity multiplier of 1.0

】

13、单选题:A firm has a retention ratio of 45 percent and a sustainable growth rate of 6.2 percent. The capital intensity ratio is 1.2 and the debt-equity ratio is 0.64. What is the profit margin? ( )

A:6.28 percent

B:9.47 percent

C:7.67 percent

D:14.63 percent

正确答案:【14.63 percent

】

14、单选题:The Soccer Shoppe has a 7 percent return on assets and a 25 percent payout ratio. What is its internal growth rate? ( )

A:5.54 percent

B:3.72 percent

C:4.49 percent

D:4.08 percent

正确答案:【5.54 percent

】

15、多选题:An increase in which of the following will increase the return on equity, all else constant?( )

A:depreciation

B:net income

C:sales

D:total equity

正确答案:【net income

;sales

】

第三章 单元测试

1、单选题:Accepting positive NPV projects benefits the stockholders because: ()。

A:it is the most easily understood valuation process.

B:the present value of the expected cash flows are equal to the cost.

C:it is the most easily calculated.

D:the present value of the expected cash flows are greater than the cost.

正确答案:【the present value of the expected cash flows are greater than the cost.

】

2、单选题:The payback period rule: ()。

A:always uses all possible cash flows in its calculation.

B:The cash flow after the payback period is ignored.

C:ignores initial cost.

D:discounts cash flows.

正确答案:【The cash flow after the payback period is ignored.】

3、单选题:A project will have more than one IRR if: ()。

A:the NPV is zero.

B:the cash flow pattern exhibits more than one sign change.

C:the IRR is positive.

D:the IRR is negative.

正确答案:【the cash flow pattern exhibits more than one sign change.

】

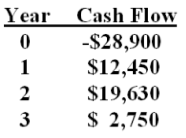

4、单选题:What is the net present value of a project with the following cash flows and a required return of 12%?

A:$177.62

B:-$287.22

C:$204.36

D:-$177.62

正确答案:【-$177.62】

5、单选题:The length of time required for a project’s discounted cash flows to equal the initial cost of the project is called the: ()

A:

internal rate of return

B:

discounted payback period

C:

net present value

D:

payback period

正确答案:【

discounted payback period

】

第四章 单元测试

1、单选题:Jamestown Ltd. currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. The company owns land beside its current manufacturing facility that could be used for the expansion. The company bought this land ten years ago at a cost of $250,000. Today, the land is valued at $425,000. The grading and excavation work necessary to build on the land will cost $15,000. The company currently owns some unused equipment valued at $60,000. This equipment could be used for producing awnings if $5,000 is spent for equipment modifications. Other equipment costing $780,000 will also be required. What is the amount of the initial cash flow for this expansion project? ()。

A:$1,110,000

B:$800,000

C:$1,285,000

D:$1,050,000

正确答案:【$1,285,000

】

2、单选题:Walks Softly, Inc. sells customized shoes. Currently, it sells 10,000 pairs of shoes annually at an average price of $68 a pair. It is considering adding a lower-priced line of shoes which sell for $49 a pair. Walks Softly estimates it can sell 5,000 pairs of the lower-priced shoes but will sell 1,000 less pairs of the higher-priced shoes by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced shoes? ()。

A:$789,000

B:$245,000

C:$177,000

D:$313,000

正确答案:【$177,000

】

3、单选题:Jamie’s Motor Home Sales currently sells 1,000 Class A motor homes, 2,500 Class C motor homes, and 4,000 pop-up trailers each year. Jamie is considering adding a mid-range camper and expects that if she does so she can sell 1,500 of them. However, if the new camper is added, Jamie expects that her Class A sales will decline to 950 units while the Class C campers decline to 2,200. The sales of pop-ups will not be affected. Class A motor homes sell for an average of $125,000 each. Class C homes are priced at $39,500 and the pop-ups sell for $5,000 each. The new mid-range camper will sell for $47,900. What is the erosion cost? ()。

A:$93,150,000

B:$18,100,000

C:$6,250,000

D:$53,750,000

正确答案:【$18,100,000

】

4、单选题:Ernie’s Electrical is evaluating a project which will increase sales by $50,000 and costs by $30,000. The project will cost $150,000 and will be depreciated straight-line to a zero book value over the 10 year life of the project. The applicable tax rate is 34%. What is the operating cash flow for this project? ()。

A:$3,300

B:$5,000

C:$8,300

D:$18,300

正确答案:【$18,300

】

5、单选题:Ben’s Border Café is considering a project which will produce sales of $16,000 and increase cash expenses by $10,000. If the project is implemented, taxes will increase from $23,000 to $24,500 and depreciation will increase from $4,000 to $5,500. What is the amount of the operating cash flow using the top-down approach? ()。

A:$4,000

B:$7,500

C:$6,000

D:$4,500

正确答案:【$4,500

】

6、单选题:Scenario analysis is defined as the: ( )

A:isolation of the effect that a single variable has on the NPV of a project.

B:separation of a project’s sunk costs from its opportunity costs.

C:determination of changes in NPV estimates when what-if questions are posed.

D:determination of the initial cash outlay required to implement a project.

正确答案:【determination of changes in NPV estimates when what-if questions are posed.

】

7、单选题:An analysis of the change in a project’s NPV when a single variable is changed is called _____ analysis. ( )

A:sensitivity

B:scenario

C:simulation

D:forecasting

正确答案:【sensitivity

】

8、单选题:An analysis which combines scenario analysis with sensitivity analysis is called _____ analysis. ( )

A:forecasting

B:simulation

C:combined

D:complex

正确答案:【simulation

】

9、单选题:By definition, which one of the following must equal zero at the accounting break-even point? ( )

A:contribution margin

B:internal rate of return

C:net income

D:net present value

正确答案:【net income

】

10、单选题:By definition, which one of the following must equal zero at the cash break-even point? ( )

A:operating cash flow

B:internal rate of return

C:net present value

D:net income

正确答案:【operating cash flow

】

11、单选题:Which one of the following is defined as the sales level that corresponds to a zero NPV? ( )

A:accounting break-even

B:cash break-even

C:financial break-even

D:marginal break-even

正确答案:【financial break-even

】

12、多选题:following changes that she is considering will help that project produce a positive NPV instead? Consider each change independently.()

A:increase the quantity sold

B:decrease the fixed leasing cost for equipment

C:increase the sales price

D:decrease the labor hours needed to produce one unit

正确答案:【increase the quantity sold

;decrease the fixed leasing cost for equipment

;increase the sales price

;decrease the labor hours needed to produce one unit

】

第五章 单元测试

1、单选题:Mary just purchased a bond which pays $60 a year in interest. What is this $60 called? ()

A:face value

B:call premium

C:coupon

D:discount

正确答案:【coupon

】

2、单选题:The current yield is defined as the annual interest on a bond divided by which one of the following? ( )

A:market price

B:face value

C:coupon

D:dirty price

正确答案:【market price

】

3、单选题:The specified date on which the principal amount of a bond is payable is referred to as which one of the following? ( )

A:coupon date

B:dirty date

C:maturity

D:yield date

正确答案:【maturity

】

4、单选题:A bond is quoted at a price of $989. This price is referred to as which one of the following? ( )

A:face value

B:dirty price

如有任何疑问请及时联系QQ 50895809